Trading Using Pivot Points

How to perfectly trades using pivot point

Tradewithxm

12/18/20242 min read

Trading Using Pivot Points

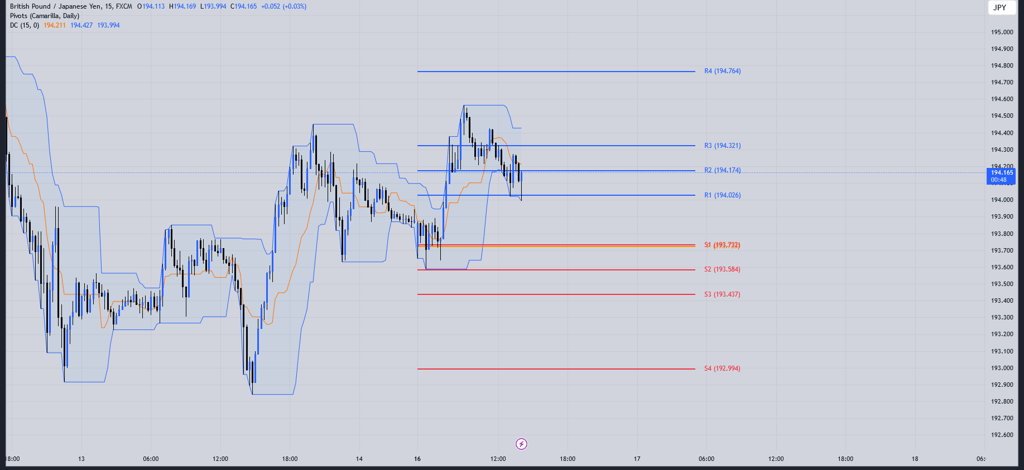

Pivot points are one of the most widely used technical analysis tools in trading. They provide traders with potential support and resistance levels, helping them make informed decisions in the market. This article will delve into what pivot points are, how to calculate them, and how you can use them effectively in your trading strategy.

What Are Pivot Points?

Pivot points are calculated levels used to identify potential turning points in the market. These levels are derived from the previous day’s high, low, and close prices. The main pivot point acts as a benchmark, while additional levels (support and resistance) are calculated around it.

Traders use these levels to determine market trends, potential entry and exit points, and areas where the price might reverse.

How to Calculate Pivot Points

The formula to calculate the pivot point (P) is as follows:

Pivot Point (P) = (High + Low + Close) / 3

Once the pivot point is calculated, you can determine the support and resistance levels:

Resistance 1 (R1) = (2 × P) - Low

Resistance 2 (R2) = P + (High - Low)

Support 1 (S1) = (2 × P) - High

Support 2 (S2) = P - (High - Low)

These calculations can be automated using charting platforms, so traders don’t need to compute them manually.

How to Use Pivot Points in Trading

Pivot points can be applied in various trading strategies. Here are some common approaches:

1. Identifying Market Sentiment

If the price trades above the pivot point (P), it indicates bullish sentiment.

If the price trades below the pivot point, it suggests bearish sentiment.

2. Support and Resistance Levels

Use support levels (S1, S2) to identify potential buy zones.

Use resistance levels (R1, R2) to identify potential sell zones.

3. Breakout Strategy

If the price breaks above R1 or below S1, it might signal the start of a strong trend.

Traders often place stop-loss orders just below or above the breakout level to manage risk.

4. Range Trading

When the market is consolidating, prices tend to bounce between pivot levels. Traders can buy at support and sell at resistance.

Advantages of Trading Using Pivot Points

Simplicity: Pivot points are straightforward to calculate and interpret.

Versatility: They work well across different timeframes and markets.

Objective Levels: Provide predefined levels for trading decisions, reducing emotional bias.

Widely Recognized: Many traders use pivot points, making them effective self-fulfilling tools.

Limitations of Pivot Points

Static Levels: Pivot points are calculated based on past data and do not adjust to real-time price changes.

False Breakouts: Prices may breach pivot levels briefly before reversing, leading to potential losses.

Need for Confirmation: Pivot points should not be used in isolation. Combine them with other indicators like moving averages or RSI for better accuracy.

Tips for Effective Trading with Pivot Points

Combine with Volume Analysis: High trading volume near pivot levels strengthens their reliability.

Monitor Market News: Significant news can cause prices to disregard pivot levels.

Test on a Demo Account: Practice using pivot points in a risk-free environment before applying them in live trading.

Stay Disciplined: Stick to your strategy and use stop-loss orders to manage risk.

Your Capital at Risk*

XM Global Year-End Bonus Claim your 100% Bonus Deposit, and activate your Lifetime 90% Auto Rebate Cashback by using our XM Partner Code 6M888

XM GLOBAL INTRODUCING BROKER

Lifetime 90% cashback on every transactions with XM Global under our IB partnership, rebates only works if you're using our XM Partners Code 6M888

CONTACT

owner@tradewithxm.com

© 2024. All rights reserved.

XM Global Limited, registered by the Financial Services Commission (FSC) under the Securities Industry Act 2021 (license number 000261/4) and Trading Point of Financial Instruments Limited, authorised and regulated by Cyprus Securities and Exchange Commission (CySEC) (licence number 120/10), are members of Trading Point Group.

Risk Warning: Our services involve a significant risk and can result in the loss of your invested capital.

Restricted Regions: XM Global Limited does not provide services for the residents of certain countries, such as the United States of America, Canada, Argentina, Israel and the Islamic Republic of Iran.